In the Know: Namada

![]()

By Gavin Birch, updated Feb 14, 2023

Privacy loves company, so Namada will reward you with NAM tokens for shielding any Ethereum/Cosmos tokens. Namada’s public testnet is running and we’re preparing for a Q1 launch. Stay In the Know and we’ll alert you about opportunities and what’s coming next.

Scammers, hackers, competitors, burglars–your assets are public knowledge, but Namada’s about to make it easy (and rewarding) to shield any assets: in Cosmos, Ethereum assets, and more to come. The more you use Namada, the stronger the privacy guarantees for everyone. Namada will be an important step toward data security in Web3–read on or skip ahead!

- Skip to Namada team (cofounder Christopher Goes, IBC design & development lead)

- Skip to getting NAM (earn NAM from privacy contributions)

- Skip to staking NAM (escalating game of cubic slashing)

- Skip to Namada governance (“liquid democracy,” off-chain gov, public goods funding)

- Skip to roadmap (bridge innovations)

Web3 can be weird and uncertain. We’re developing our Namada Knowledge Hub to make Namada knowable.

.

What’s Namada?

Interchain asset privacy. Why? Web3 promises secure digital ownership and control, but not over your information. Everything we do in crypto is exposed to everyone–imagine if everyone in the world could see your entire history of credit card purchases and bank statements. Even if your address isn’t publicly known, it’s only a matter of time before all of your assets and transactions are exposed. Even something as simple as sending someone tokens reveals to them your entire transaction history.

How could Web3 be adopted by an organization–a business, advocacy group, government (or anyone with anything to lose to an adversary), if all of our transactions are observable? Assuming that all of our assets, and our patterns of transactional behaviours continue to be known by all.

Namada will be a PoS blockchain that offers interchain asset privacy, and Namada’s user-friendly interfaces will make privacy-preserving transfers more accessible. Simple, understandable privacy for any asset. Fast and cheap, with strong security guarantees.

At launch (Q1 2023), Namada will enable you to shield any Ethereum or Cosmos assets, including NFTs like ENS names. You’ll earn NAM (Namada’s native token) for any assets held by Namada, because more shielded assets strengthen the privacy guarantees for all participants. Stay In the Know for updates and learn how to earn from shielding assets.

It’ll be easy and permissionless to transfer Ethereum and Cosmos assets to Namada, which will use a single, common shielded pool for all assets (fungible and non-fungible). “Transferring a CryptoKitty is indistinguishable from transferring ETH, DAI, ATOM, OSMO, NAM or any other asset on Namada,” cofounder Awa Sun Yin wrote in the Oct 2022 article ‘What is Namada?’ (a great first step toward a technical deep dive). If you have time, check out some talks. Helpful links:

- Introducing Namada: Interchain Asset-agnostic Privacy (Awa’s May 2022 article)

- Namada Specifications lays out all Namada details (maintained by core team)

- Namada Documentation is a guide to using Namada (maintained by core team)

- Maintained by core team: website; Twitter; GitHub; Reddit

- Knowable’s Namada Knowledge Hub

.

Anoma

You may have heard of Anoma, so let’s clarify. While Namada will initially look a lot like a Cosmos chain at launch, Namada will evolve as the first “fractal instance” of Anoma. The Anoma chain (Q4 2023) will offer an interchain coordination layer with full-stack privacy. Users express what they want instead of how to get it (and the system operators are responsible for figuring out how to get it). Anoma removes the need for centralized counterparty discovery points, like AMMs (Uniswap) and orderbooks. Anoma’s framework will enable many decentralized apps and chains to launch (similar to the way the Cosmos SDK enabled many chains to launch).

If you’re curious about Anoma, Stay In the Know and we can alert you about what’s coming next for Anoma. In the meantime check these out:

- Anoma explainer video (19 mins; Sep 2022)

- An Overview of Anoma’s Architecture article (Mar 2022)

- Anoma: an intent-centric coordination framework video (15 mins; Jul 2022)

If you have the time, this Epicenter video (1hr14mins; Apr 2022) is probably the best glimpse at the founding team and Anoma in relation to Namada.

.

Heliax is launching Namada

Heliax (branded a public goods lab) is known for their former protocol development and validator staking service, Cryptium Labs. For three years, they shipped all major Tezos protocol upgrades in collaboration with Nomadic Labs. The founders are perhaps best known for their work on Cosmos.

Heliax cofounder Christopher Goes (blog) led the design and development of IBC, the Inter-Blockchain Communication protocol. IBC is a key innovation for secure cross-chain communication that currently connects many high-value blockchains together. Being the gold cross-chain standard that binds the Cosmos ecosystem, IBC is also being adopted by ecosystems well beyond Cosmos.

Cofounder Awa Sun Yin is a former Chainalysis data scientist, a firm dedicated to deanonymizing and tracking Web3 users: “I used to work for surveillance capitalism, now I work on goods for the public” (check out her blog). She was later a researcher at Tendermint Inc for Cosmos, and then formed Cryptium Labs with Christopher and Adrian.

Adrian Brink was the third core protocol engineer to work on building the Cosmos stack at Tendermint Inc., built and scaled Cryptium Labs, and is now CEO of Heliax. Adrian’s graduate thesis topic was “censorship-resistant e-voting systems as a means of helping the Catalan people to gain their independence.”

Together they’ve attracted and built the talented Heliax team, which has grown to nearly 50 people over the past three years, raising funds from Polychain, Electric Capital, Coinbase Ventures, Maven 11, and from the Knowable team for the Anoma Foundation.

.

Namada’s staking token: NAM

A blockchain must charge a fee for each transaction (otherwise it would be trivial to overload the network with spam transactions), and NAM is Namada’s primary fee token. “Primary” because Namada will also enable other tokens to be used to pay transaction fees, making Namada more accessible for new users.

NAM will also be the staking token, meaning that participants will put NAM at stake as a bond; a form of economic guarantee that operators (ie. validators) will follow the protocol rules (or risk losing the bonded NAM backing their operations) so that Namada will predictably work the way that users expect.

New NAM will be issued to pay participants: stakers that secure Namada’s operations, users that contribute to data security by shielding their assets, and public goods contributors selected by the public goods council–they’ll all be paid with newly-minted NAM.

.

Getting NAM

- Earn NAM for shielding your Ethereum/Cosmos assets

- Get awarded NAM for digital privacy and public goods efforts

- Trading for NAM

- Earn by staking NAM

Perhaps the most permissionless way to get NAM is to shield your assets. Stay In the Know, we’ll alert and guide you to know what to expect. You’ll be able to move Ethereum assets like ETH and USDC to Namada, as well as Cosmos assets like ATOM and OSMO. Not only will your assets be private while on Namada, but they’ll earn NAM tokens.

If you’re a contributor to digital privacy, you may receive NAM at launch if you were nominated and awarded in the retroactive public goods funding program. This program will continue to run after Namada launches, rewarding contributors to public goods. Reach out or nominate people you know who are digital privacy researchers, impementers, advocates, artists–anyone helping to change how we think about digital privacy, particularly those who may not be well recognized. Contact us and we can help with the nomination.

At launch, various stakeholders will have NAM allocations, such as the trusted setup participants. (Missed the trusted setup? Stay In the Know to be alerted about future Namada opportunities.) Token-holders may wish to sell some of their tokens, so we can expect NAM markets to emerge soon after Namada launches. Since Namada will have a native Ethereum bridge and use IBC, we can expect to find NAM markets with Osmosis in Cosmos DEX and DEX aggregators like Matcha on Ethereum. Beware counterfeit NAM, as scammers may attempt to market a fraudulent NAM token ahead of the launch.

If you (like we) see a future for Namada, you may want to stake to earn more NAM. We’ll be running a local, bare metal validator alongside a stellar set of validator operators. If you want to set up a validator, we’ll share our guide. If you want to partner with us, the most straightforward way is to delegate to our validator. Contact us to discuss partnering.

.

Staking NAM

When you stake, you’ll earn NAM. The experience will be similar to Cosmos staking/delegating–your validator won’t custody your tokens, and you retain control over your staking income and how your tokens are staked (within the rules of the protocol).

Stay In the Know about staking updates, and reach out about staking.

Nothing is certain, but these are our expectations. Your delegation will take 24 - 48 hours to take effect (and start earning). While the docs suggest 7 - 8 days to unstake, it’s still being determined and could be closer to 21 days. Rewards will be paid once every 24 hours and will be added to your stake to compound (so rewards won’t be liquid until you unstake them).

The Namada supply will increase to pay stakers, a dynamic floating rate; the maximum annual rate being 10% (and the minimum is to be determined). So if 50% of NAM is staked and issuance is 8%, the reward rate will be 16% and issuance will increase until reaching a 20% cap. If 68% of NAM is staked, the reward rate will be 11.75% and decreasing.

.

Staking risks

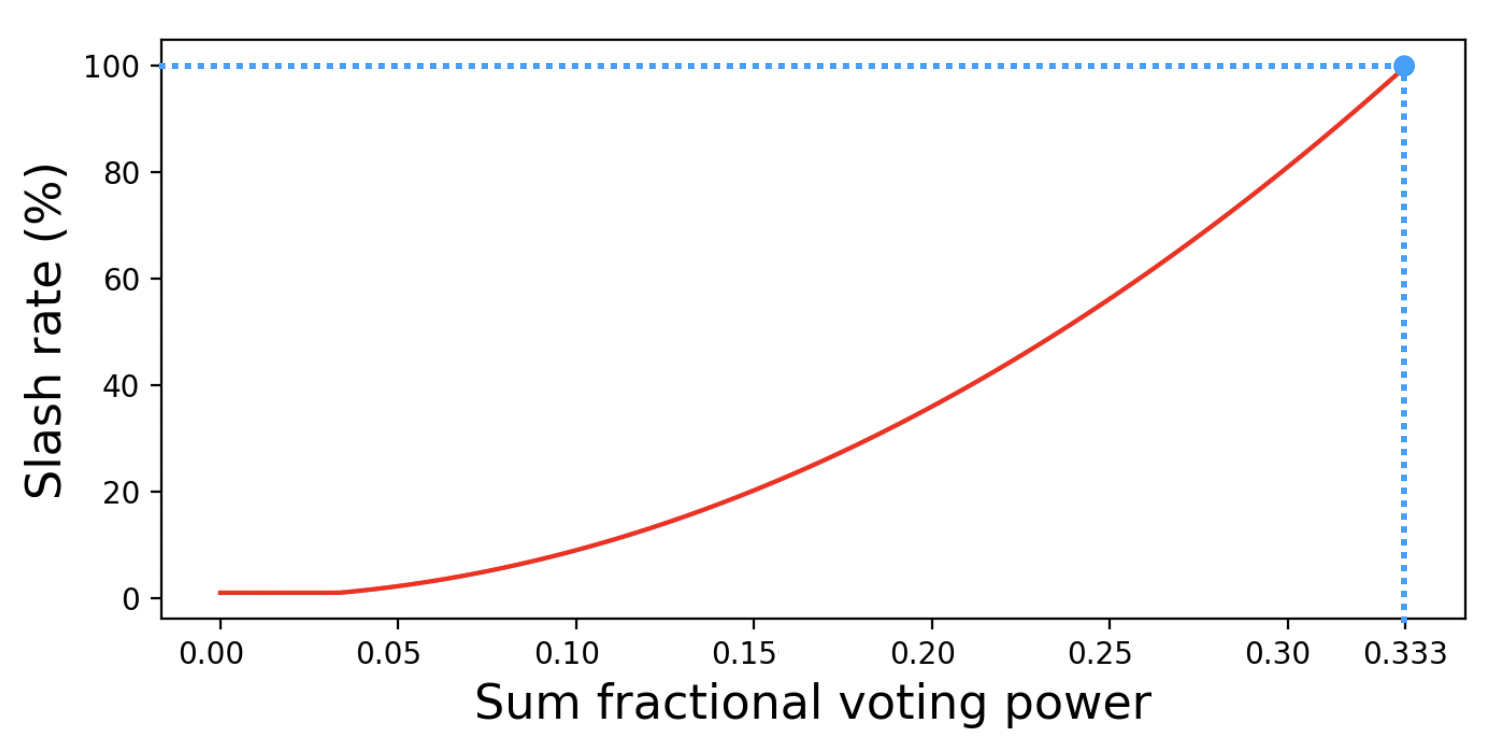

The primary risk for stakers is from a validator that equivocates (signs one block twice) or a validator that produces / votes for an invalid block. Namada uses an escalated slashing mechanism called “cubic slashing,” which exponentially increases the penalty based on how much stake a validator has. Large validator operators often offer a “white label validator” service, which means that one entity could be running several seemingly independent validators. At the extreme end, delegators to an offending entity running validators that have 34% of stake combined–they will lose 100% of their stake.

If a validator goes offline (stops signing blocks), their delegators won’t earn. If you have delegated $100k in tokens earning 16%, you’ll miss earnings of ~$1.73 per hour that your validator is offline, but there will be no slashing for downtime.

.

Governance

Namada’s governance mechanism will also resemble Cosmos governance, but with some noteworthy updates. When you delegate, by default your validator represents your stake when voting in governance. But you can change that–you can select a different representative for governance voting, and of course you can always override their vote with your own vote.

On-chain proposals can carry wasm code that can be executed if the proposal passes, so any number of decisions can be executed on-chain (like a protocol parameter, or refunding a slashed amount).

Namada will also enable off-chain signalling, so that validators can coordinate even if the chain is halted, signalling using their stake based on the last snapshot.

Finally, Namada will experiment with public goods funding. A council will be elected every six months to allocate newly-issued NAM for technical research, engineering, social research / art / philosophy, and for external public goods (see more here).

We intend to participate in Namada’s governance experiments, Stay In the Know about Namada’s governance.

.

At Launch vs Future

You’ll be able to move Ethereum and Cosmos assets at launch. Cosmos assets will use IBC, and Ethereum assets will use a fully custom bridge that prioritizes security optimization. If bridges (understandably) make you wince, you’ll want to understand Heliax’s Ethereum bridge design–custom-built to optimize for security (recall that Christopher led IBC) and to minimize latency. We anticipate custom bridge designs for Bitcoin and Polkadot chains later.

Namada is positioned to provide privacy as a public good. But public goods are non-rivalrous, meaning that when each person that shields their assets adds to the privacy guarantees, make the privacy service better, rather than using it. Namada should not be competing with other privacy-preserving chains for users in its privacy set (since fewer users and transactions make for weaker privacy guarantees).

In the second phase of Namada, Heliax intends to implement bridges to other privacy-focused ecosystems, like Zcash (already proposed), Aleo, and Penumbra. Ideally we’ll see a wallet designed to support privacy-preserving ecosystems as well. We anticipate Namada will prevent validators from seeing transactions before finalizing them (using Ferveo), which should increase censorship resistance.

You lose privacy whenever you transact between chains, so third phase: private bridges, which will enable all privacy-preserving chains to share a privacy set. We should have governance and PoS improvements to look forward to, as well as moarr bridges.

Perhaps the coolest thing about Namada is that Namada will introduce novel innovations from Anoma, which we anticipate will be the first legit third generation blockchain ecosystem.